What’s Changed: Gartner’s 2016 Application Platform as a Service (aPaaS) Magic Quadrant Report

Enterprise technology analysis and research firm Gartner Inc. released the latest iteration of its Magic Quadrant for Enterprise Application Platform as a Service (aPaaS) last week.

Enterprise technology analysis and research firm Gartner Inc. released the latest iteration of its Magic Quadrant for Enterprise Application Platform as a Service (aPaaS) last week.

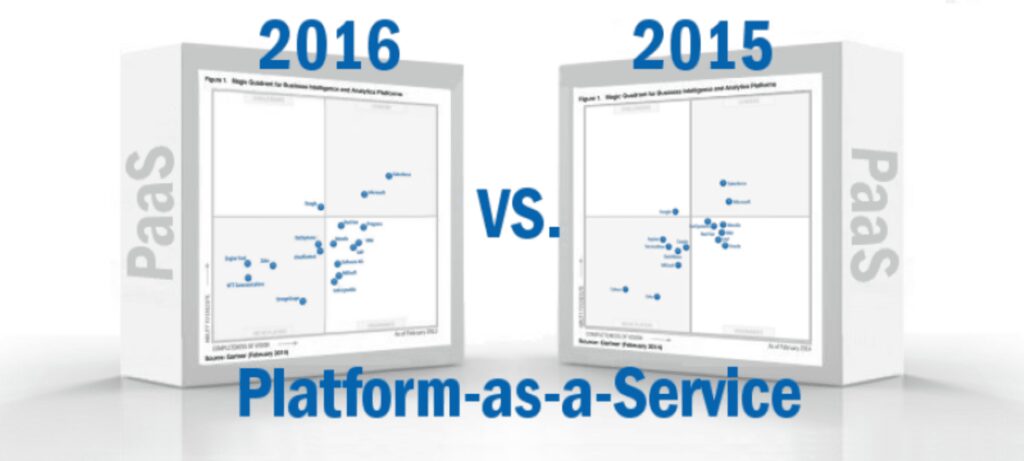

In the 2016 Magic Quadrant for Enterprise aPaaS, Gartner evaluates the strengths and weaknesses of what it considers leading vendors in the enterprise aPaaS market and provides readers with a graph (the ‘Magic Quadrant’) plotting the vendors based on their ability to execute, and completeness of vision. The graph is divided into four quadrants: niche players, challengers, visionaries, and leaders. Gartner does not endorse any vendor, product, or service depicted in its research publications.

At Solutions Review, we read the 30-page report, available to Gartner subscribers here, and pulled a few of what we considered the most important takeaways and key changes since the 2015 edition.

This is the third time Gartner has released a Magic Quadrant (MQ) for aPaaS since they introduced aPaaS as a category in 2014, and there have been some changes in vendor positions, as well as the addition of new players, and the removal of some others.

The 16 vendors included in Gartner’s report are Appian, Caspio, Cybozu, Google, IBM, Mendix, Microsoft, MIOsoft, Oracle, OutSystems, QuickBase ,Red Hat, Salesforce, SAP, ServiceNow, and Zoho.

We read the 37-page report and pulled a few of what we consider the most important takeaways and key changes from last year’s aPaaS Magic Quadrant.

How to read Gartner’s Magic Quadrant.

What is aPaaS?

Gartner defines application platform as a service (aPaaS) as a platform as a service (PaaS) offering “that supports application development, deployment and execution in the cloud, encapsulating resources such as infrastructure and including services such as those for data management and user interfaces.”

Enterprise aPaaS, says Gartner is aPaaS specifically designed to “designed to support the enterprise style of applications and application projects (high availability, disaster recovery, external service access, security and technical support).”

Gartner’s report only includes companies that provide public cloud aPaaS offerings and does not include private or hybrid aPaaS providers.

Widget not in any sidebars

Movements on the Chart

Though the market as a whole has been steady, there have been significant gains and losses in placement for individual vendors on the Magic Quadrant since last year. Here two of the major movements for vendors on both the 2015 and 2016 aPaaS Magic Quadrants:

MIOsoft looses points on ‘completeness of vision.’ The Wisconsin-based vendor of data-centric, high-productivity aPaaS dipped from the ‘visionaries’ quadrant in 2015 into dreaded ‘challengers’ positioning in 2016, with a significant loss in ‘completeness of vision.’ Gartner warns that “MIOsoft’s focus on NoSQL/Hadoop analytical data models makes its platform less suitable for simple transactional applications using a basic relational data model. The platform is not suitable for migrating existing enterprise applications to the cloud,” but notes that the platform’s best-in-class data integration capabilities make it an attractive solution for many customers.

Zoho drops in ‘ability to execute.’ Zoho’s Zoho Creator aPaaS has always been a challenger, but this year’s report finds the database-centric business aPaaS languishing closer to the bottom left than ever, thanks to a significant loss in ‘ability to execute.’ Gartner warns that Zoho Creator is “suited only to the simplest of enterprise applications,’ and “caters only for the simplest of applications and provides minimal application life cycle management.” On the flipside, that simplicity makes Zoho Creator “a very easy-to-use platform,” says Gartner. “Applications can be built quickly, with little or no involvement from IT staff.”

Vendors Added and Dropped

The most significant change from one Magic Quadrant to the next is always the addition (and removal) of vendors. Here are the biggest change-ups in this year’s report:

A Glimpse of Vendors Added:

Appian, QuickBase, ServiceNow and more: Gartner added these several vendors because they were “deemed to offer sufficient cloud and enterprise capabilities,” and they met the requirements of at least $1 million revenue and at least 30 paying customers.

Appian was added after shifting significantly towards the aPaaS market from a previous focus on its business process management PaaS offering. ServiceNow was added because the vendor has made it’s aPaaS offerings available outside of its SaaS offerings.

A Glimpse of Vendors Dropped:

Indra Systems, Software AG, and cloudControl were three of many dropped from Gartner’s 2016 report because they didn’t pass the raised inclusion criteria for revenue and/or customer count, though Gartner notes that these vendors are still strong choices for many clients. cloudControl was notably removed due to its bankruptcy and subsequent shutdown in February 2016.

Salesforce and One Other Vendor Named Market Leaders:

Gartner defines market leaders as vendors who “combine an insightful understanding of the realities of the market, a reliable record, the ability to influence the market’s direction, the capability to attract and keep a following, and the capacity to lead.”

Though Gartner identifies market leaders, they are careful to point out that large market leaders are not always the right choice for a business. “A focused, smaller vendor can provide excellent support and commitment to individual customers,” according to the report. View The report here for a better look at the leaders of the aPaaS market.

Widget not in any sidebars