Gartner’s 2016 Enterprise Content Management Magic Quadrant: What’s Changed?

ECM is gaining momentum as a data solution that can help enterprises take control of their content. Analyst house Gartner, Inc. has released the latest iteration of its annual Magic Quadrant for Enterprise Content Management (MQ) report. This 2016 Magic Quadrant for Enterprise Content Management( ECM) was published in October 2016.

ECM is gaining momentum as a data solution that can help enterprises take control of their content. Analyst house Gartner, Inc. has released the latest iteration of its annual Magic Quadrant for Enterprise Content Management (MQ) report. This 2016 Magic Quadrant for Enterprise Content Management( ECM) was published in October 2016.

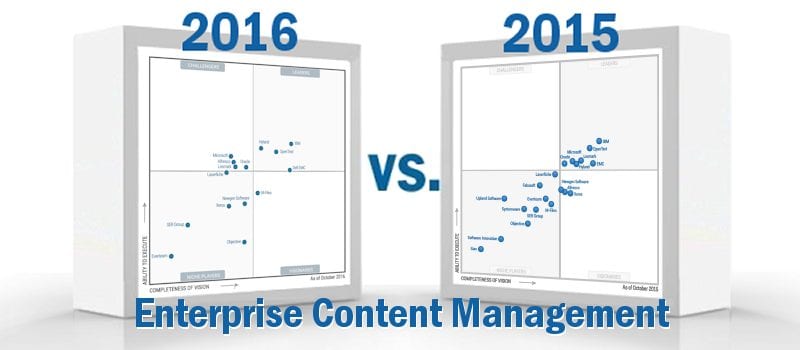

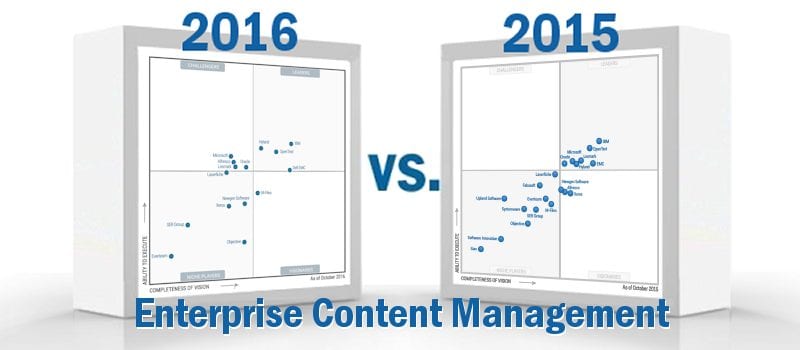

The ECM category is subject to a rapidly changing landscape, and Gartner recognizes that these shifts in the market will affect clients strongly- and not just regarding their MQ positioning.

“Consolidation in the market continues, with ever more tools that once belonged in the realm of specialist vendors now being part of the large ECM suites. These include enterprise file synchronization and sharing (EFSS), video content management and asset management. The ECM vendors build out these functionalities or acquire them through partnerships or direct acquisition of the technologies.” These acquisition of tools and tech are what play a major role in this year’s MQ, ‘Heave, Ho!’, as Gartner raised most vendor scores in ability to execute, topped off witha slight push to the right: advancement in completeness of vision.

If you’re unfamiliar with the MQ, Gartner evaluates the strengths and weaknesses of 15 vendors in 2016- that’s a slight drop from the 20 vendors featured in MQ 2015.These vendors are considered most significant in the market, and Gartner provides a graph (the Magic Quadrant) to plot the vendors based on their ability to execute a product or service, sales and/or pricing, etc and by a vendor’s completeness of vision. That graph is divided into four quadrants: Niche Players, Challengers, Visionaries, and Leaders.

This is the thirteenth iteration of the ECM Magic Quadrant report, and as you might expect, there have been massive changes in the ever-evolving ECM market since Gartner’s first MQ report, in 2004. In the last year alone we’ve seen considerable shifts in positions on the MQ. At Solutions Review, We read the 38 page report, and pulled a few of what we consider the most important takeaways and key changes from the 2015 ECM Magic Quadrant.

What is Enterprise Content Management?

According to Gartner, the term “enterprise content management” (ECM) is described as a set of services and microservices, embodied either as an integrated product suite or as separate applications that share common APIs and repositories, to exploit diverse content types, and serve multiple constituencies and numerous use cases across an organization. As a strategic framework, ECM can help enterprises take control of their content.

“It can contribute to initiatives around transactional processes, compliance and records management as well as sharing and collaborating around content and documents. As a technical architecture, ECM can be delivered either as a suite of products integrated at the content or interface level or as a number of separate products that share a common architecture.”

I’ts no wonder that this year, research firm MarketandMarkets reported that the Enterprise Content Management market is expected to see revenue grow from $28.10 billion in 2016, to $66.27 billion by 2021.

How has the market changed? Ability to Execute

Ability to Execute measures how well a vendor is able to sell and support its ECM products and services. The vendors are also rated on their financial viability, which is done by a standard Gartner methodology that does not equate size with financial stability. Feedback on the current installed base, customer support, customer satisfaction and information about migrations is also taken into consideration.

“In addition to the core components of ECM software, vendors receive recognition for extended components, such as those for EFSS, enterprise search, digital asset management and web content management, which are critical to ECM. They also receive credit for supporting other functionalities, such as output management and archiving, messaging and email management.“

Content management investments, while having a natural ebb and flow, continue to expand. As vendors work to enhance these capabilities they are able to offer more intelligent, fast, and homogeneous software to consumers who are looking for a content solution. These capabilities are the thing of an MQ leader.

Quadrants

Niche Players

In 2016, Vendor, Laserfiche hover slightly over the line of Niche and Challengers quadrant, leaving only a slight push in ability to execute to make the challenger’s cut. Gartner explains it’s on-the-fence stance:

“Despite improvements, the technical support offered by smaller Laserfiche resellers is not always to the satisfaction of their clients. Customers should look for Laserfiche Gold resellers and Laserfiche certified partners with demonstrable product knowledge.”

Niche players are plentiful in this year’s quadrant described as, “Niche Players typically focus on specific categories of ECM technology (such as transactional content management technology), midmarket buyers, or supplements to the offerings of business application or “stack” providers.”. This year’s Niche vendors also include, Newgen Software, Xerox, Objective, SER Group, and Everteam.

Visionaries

Gartner’s guide describes Visionaries: “Visionaries typically show a strong understanding of the market and anticipate shifting market forces. They may lead efforts relating to standards, new technologies or alternative delivery models, but they have less Ability to Execute than Leaders.”

Visionaries are typically smaller companies but have a very good awareness of how the market will evolve. Gartner uses “market understanding” as one of the evaluation criteria in positioning a ECM vendor’s completeness of vision, along with offering product strategy, and innovation. Vendor, M-Files which is based in Tampere, Finland is noted for M-Files’ native mobile app which lets users access documents offline, and was complimented for its support features like the ability to scan directly from tablet or mobile phone, inclusion of electronic signatures, and its reviewing and approving capabilities. M-Files is the only vendor in this year’s Visionary MQ.

Challengers

Challengers are characterized as not possessing all of the essential functional components of ECM software as the Leaders do, and also for the tendency to leverage third party partnerships to fill out their offerings. This year’s MQ features four vendors, Oracle, Lexmark, Microsoft, and Alfresco, who is making it’s mark on the market in recent years with a growing collection of ECM offerings. Alfresco’s open-source-based platform is described by Gartner as a great solution for technology buyers who want to customize and optimize their ECM implementations in a variety of deployments and cloud implementations.

Leaders

And finally, to this year’s leaders, defined as ECM software providers that, “Are perceived in the industry as thought leaders, and have well-articulated plans for enhancing recovery capabilities, improving ease of deployment and administration, and increasing their scalability and product breadth.” Wouldn’t you know, the leader quadrant is saturated with vendors that fit the bill, including IBM, OpenText and more.

Market Overview

Gartner reports that the ECM market grew by 9.4% in 2015 to a worldwide revenue total of $5.9 billion in constant currency. That compares with a 2014 growth rate of 6.2% and a worldwide revenue total of $5.4 billion. The top-three vendors lost market share in 2015, while their smaller rivals gained. More notably, best-of-breed, local and multicountry vendors accounted for 33.8% of the market in 2015, up from 27.9% in 2013.

“Vendors are also responding to the new market dynamics. In 2015, several of the larger ones announced strategic plans and actions to recast their ECM approach, including buyouts, spinoffs and a willingness to sell off software assets. A restructuring of the market is therefore likely.” Gartner predicts for the new year ahead for the content management market.

For the full report, grab your copy of the new 2016 ECM MQ HERE, and for more Content Management vendor information, including profiles, and product feature reviews, download our completely free 2016 Enterprise Content Management Vendor Buyer’s Guide.

For more about Gartner’s news and reports, follow us on Twitter, and Linkedin and stay current on the most up-to-date news and trends in information governanace.

[/box]

Widget not in any sidebars