What’s Changed: 2018 Gartner Magic Quadrant for CRM Lead Management

The editors at Solutions Review highlight what’s changed since the last iteration of the Gartner Magic Quadrant for CRM Lead Management and provide an analysis of the new report.

Analyst house Gartner, Inc. has officially released its 2018 Magic Quadrant for CRM Lead Management. The report highlights some of the top vendors offering CRM Lead Management capabilities in the marketplace. According to Gartner, “Lead management integrates business process and technology to close the loop between marketing and direct or indirect sales channels, and to drive higher-value opportunities through improved demand creation, execution and opportunity management.”

What is CRM Lead Management?

CRM Lead Management encompasses any interactions between a marketing team and a prospective client including, but not limited to, acquiring and sorting potential leads from a variety of sources, email interactions, scoring and segmenting leads based on their unique needs and demographics, and relaying the most qualified and highest value leads to the appropriate sales channels after they’ve been sent through a nurturing workflow.

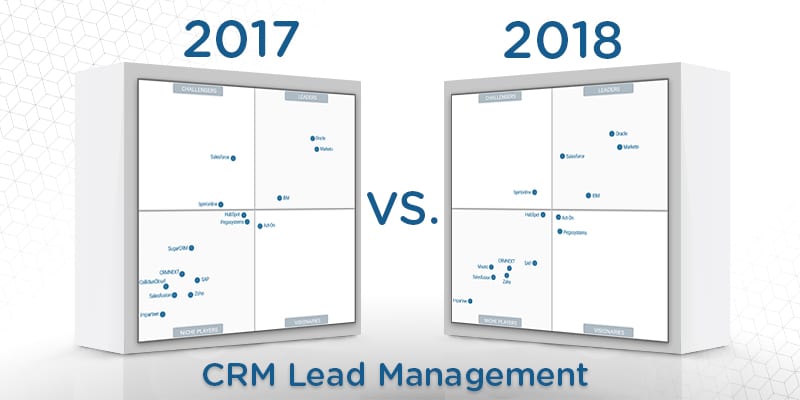

The Magic Quadrant evaluates the credentials of 14 vendors that offer their own take on the application. As with Gartner’s other Magic Quadrants, the vendors were assessed based on accounts given by a handful of reference customers and then accordingly scored into four categories: Leaders, Challengers, Visionaries, and Niche Players.

The 2018 CRM Lead Management Magic Quadrant includes assessments of the following vendors: Act-On, bpm’online, CRMNEXT, HubSpot, IBM, Impartner, Marketo, Oracle, Pegasystems, Salesforce, Salesfusion, SAP, Zoho, and newcomer to this Magic Quadrant, Mautic.

We reviewed the report and pulled some key points of interest.

Four Market Leaders

Based on their scoring, Gartner has named the following four vendors as market leaders concerning their CRM Lead Management capabilities: Oracle, Marketo, IBM, and newcomer to this quadrant Salesforce. As mentioned, the vendors were scored on the completeness of their vision which factored in criteria such as their market understanding, market and sales strategies, business model, geographic strategy, and overall innovation.

The vendors were also scored based on their ability to execute, including the company’s overall viability, sales execution to date, marketing effectiveness, customer experiences, and product/service itself.

What’s Changed and What to Expect

The most obvious shake-up in this year’s edition of the report is the ascent of Salesforce. Firmly a Challenger in last year’s report, this vendor has made its way to the Leaders quadrant. Reference customers noted a significant improvement in the product’s functionality, with full integration with Pardot and other staples of marketing software. In conjunction with its already high standing as a Challenger, this improvement helped push Salesforce into the Leader quadrant with last year’s leaders, IBM, Marketo, and Oracle, all of which remain in largely the same standing as the previous year.

These Leaders remain juggernauts within the market with good reason; their ability to process high volumes of data and superior integration capabilities is chief among all of their strong suits. However, reported difficulty in deployment and the rising cost of ownership are things you should be keeping in the back of your mind when considering Oracle and Marketo.

Salesforce’s move to the Leader’s quadrant wasn’t the only major shift. Pegasystems, formerly a higher-tier Niche Player, now ranks amongst the Visionaries. The folks at Pegasystems took last year’s report to heart and improved upon their already expansive AI program, Customer Decision Hub (CDH.) Not only can CDH deliver insights during the lead management process, but it can also score leads and pick out surface influencers that can give sales teams a better view of a lead and ultimately assist in securing the purchase. Though it appears not much has been done about the vendor’s complex user interface, the AI program is sure to help it stand out amongst the crowd in future years.

Another clear, yet less dramatic, development is the inclusion of Mautic, which enters the fray as a mid-tier Niche Player. The report is quick to highlight places Mautic can improve, particularly regarding customer sentiment regarding gaps in capabilities and the vendor’s overall freshman status in the market. But inversely, Gartner does not understate the product’s strong value, the exemplary customer service/support, and the overall flexibility of the software, keeping Mautic a more than viable option.

Mautic’s companions in the lower-third of the Niche Players quadrant are Impartner, Zoho, Salesfusion, and SAP. Though Impartner is a niche in the truest sense of the word, it fulfills that niche, letting global organizations manage indirect sales partners. Though lacking the ability to create landing pages, Zoho offers extremely versatile pricing options and interfaces extremely well with existing Zoho products, making it enticing for organizations already invested in that ecosystem.

This year’s list also sees the omission of both CallidusCloud and SugarCRM. The former was because, over the course of the last year, CallidusCloud was absorbed into SAP and was assessed in conjunction with that vendor. No hard reason was listed for SugarCRM’s absence, but Gartner notes that its Magic Quadrants are liable to change year to year. Microsoft and Adobe remain absent for the second year running due to Adobe slowly phasing out its lead management module, which was officially delisted in 2017. Microsoft’s announcement of Dynamic 365, though it does contain led management tools, came too late for it to be accurately featured in the report.

The CRM Lead Management market saw a 14% increase in growth in 2017, and Gartner sees the market continuing to grow in the coming years based on the higher value B2B and customer purchases that are commonplace in it.

Read Gartner’s Magic Quadrant Report.