Key Takeaways: The 2020 Gartner Market Guide for Digital Experience Monitoring

Analyst house Gartner, Inc. recently released its new Market Guide for Digital Experience Monitoring. The researcher’s Market Guide series is meant to cover new and emerging markets where software products and organizational requirements are in limbo. Gartner’s Market Guides can be a great resource for understanding how a fledgling space may line up with current and future technology needs.

According to Gartner, “With the focus on early, more chaotic markets, a Market Guide does not rate or position vendors within the market, but rather more commonly outlines attributes of representative vendors that are providing offerings in the market to give further insight into the market itself.” Though Gartner’s Market Guide is not provider-centric, it aims to provide a more overarching view of the software space. However, the researcher does mention the major players as things take shape.

Gartner highlights the following providers of digital experience monitoring (DEM) tools: 1E, 7SIGNAL, Apica, AppNeta, Aternity, Broadcom, Catchpoint, Cisco (AppDynamics), Citrix, Datadog, Dynatrace, eG Innovations, ENow Software, HCL Technologies, Hive Streaming, IBM, ITRS Group Ivanti, Kentik, Lakeside Software, Liquidware, ManageEngine, Martello Technologies, Micro Focus, Microsoft, NetMotion, New Relic, Nexthink, OneAPM, Oracle, Quantum Metric, Rigor, Sinefa, SolarWinds, Tanium, ThousandEyes, Tingyun, VMware, and Zscaler. At Solutions Review, we read the report, available here, and pulled out the key takeaways.

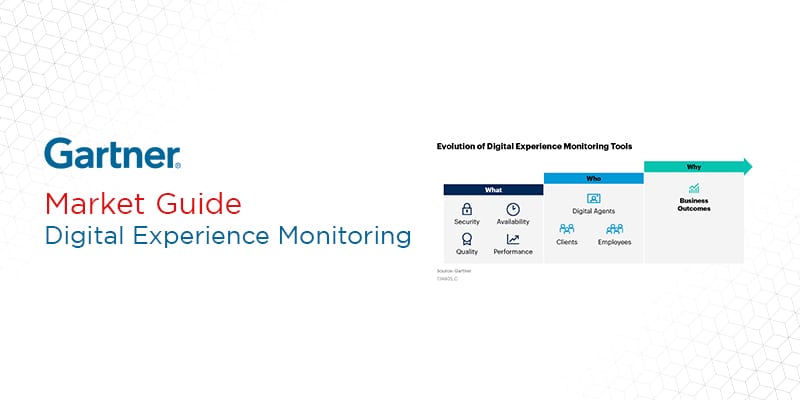

Gartner defines DEM solutions as technologies that “monitor the availability, performance, and quality of experience an end-user or digital agent receives as they interact with an application and the supporting infrastructure. Users can be external consumers of a service (such as patrons of a retail website), internal employees accessing corporate tools (such as a benefits management system), or a combination of both. DEM technologies seek to observe and model the behavior of users as a continuous flow of interactions in the form of user journeys.”

DEM tools are being deployed at similar rates to other monitoring tools with expanding market spaces, including application performance monitoring and network performance monitoring and diagnostics. Gartner claims that DEM helps fill the gaps that these monitoring tools leave open — in particular, degrading performance on the user’s end. Adopters of DEM solutions gain new capabilities in omnichannel operations, remote worker experience, employee productivity, and proactive network path analysis. While it is impossible for companies and IT administrators to see a full picture of their network and system performance with a DEM solution, digital experience monitoring complements other technologies to give a wide breadth of insight into how their systems perform at any given time.

The recent rise in remote work, work-from-home, and digital transformation initiatives spurred on primarily by the COVID-19 pandemic has prompted stronger demand for DEM tools. Endpoint monitoring and real user experience monitoring have both become important capabilities for companies weathering the storm of the coronavirus pandemic. User and employee productivity is another metric that managers want to analyze, but DEM doesn’t fully deliver on this statistic. IT administrators can monitor how a company’s services and solutions perform for users, but DEM solutions cannot fully measure how productive an employee is working.

Gartner analysts stated in the report that “The global pandemic is increasing the demand from organizations for endpoint monitoring tools. These technologies are instrumental in helping I&O leaders to enable the massive shift in remote working. Gartner inquiry data for the first months of 2020 grew five times compared to 2019, as IT organizations struggled to gain visibility into end-user experience as they access applications using home computers and sharing home networks.”

Read the Market Guide for Digital Experience Monitoring here.

Looking for a solution to help you improve your network performance? Our Network Monitoring Buyer’s Guide contains profiles on the top network performance monitor vendors, as well as questions you should ask providers and yourself before buying.

Check us out on Twitter for the latest in Network Monitoring news and developments!