What’s Changed: 2015 Gartner Magic Quadrant for Enterprise Backup and Integrated Appliances

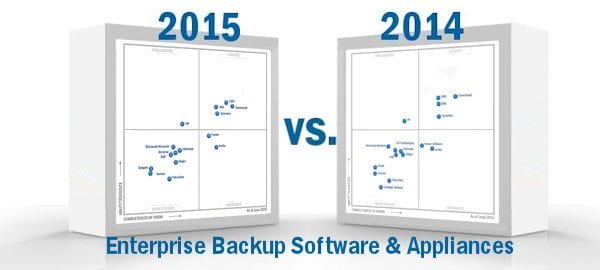

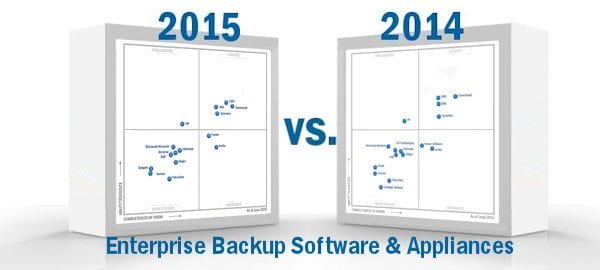

As you may know, Gartner recently unveiled their 2015 iteration of the Magic Quadrant for Enterprise Backup and Integrated Appliances, a report which we summarized thoroughly here. I thought it’d also be valuable to cover the Magic Quadrant in another way by comparing this year’s report to the 2014 version to see precisely “what’s changed.”

As you may know, Gartner recently unveiled their 2015 iteration of the Magic Quadrant for Enterprise Backup and Integrated Appliances, a report which we summarized thoroughly here. I thought it’d also be valuable to cover the Magic Quadrant in another way by comparing this year’s report to the 2014 version to see precisely “what’s changed.”

Gartner’s 2015 report includes the same cast of characters as last year’s, with the only exception being Catalogic Software, dropped from the list because the company “no longer met all of the inclusion criteria for this iteration of the Magic Quadrant.” The only other notable differences to the included vendors is that CA Technologies is now Arcserve, and EVault is now a wholly owned subsidiary of Seagate and is now rebranded to use the parent name.

What I found rare in comparing the 2014 and 2015 versions of Gartner’s report is that none of the solutions providers were moved into different quadrants. That is, each vendor that was included in the 2014 version of the report stayed in the same bracket. In addition, no companies made dramatic moves within their own quadrants. However, there were some small but subtle changes in position.

In the Leaders bracket, Commvault still holds a slight edge over EMC in completeness of vision, but EMC has crept ahead in their ability to execute. The two companies are in a dead-heat for the top overall spot in Gartner’s diagram. There’s now a little less separation between IBM and Symantec, as the PC security giant has made up some ground on IBM since last year.

The Challengers quadrant shows virtually no change, with HP sitting in the lower right-hand side of the bracket once more. One wonders if Gartner forgot to update this portion of the diagram.

The Visionaries quadrant is eerily similar as well, but if you look close enough you can see some positional changes. This portion of the diagram is still inhabited by Veeam and Actifiio, although both companies have made minor strides in their completeness of vision, according to Gartner. Actifio currently sits closer to the middle of the square than does Veeam, but the latter now has a chance to move into the Leaders bracket as soon as next year.

The still-crowded Niche Players quadrant also shows very little change from the diagram that was released a year ago. Outside of CA Technologies and EVault evolving into Arcserve and Seagate, the only minor change that can be seen is a slight step back by Asigra. None of the other solutions vendors were moved a notable distance.

Gartner’s vendor placement within the Magic Quadrant makes one thing clear: there has not been much of a change in enterprise backup and integrated appliances since the 2014 report was created. Gartner explains: “As the backup/recovery software and integrated appliance market comprises dozens, if not hundreds, of vendors, this report narrows it down to those that have strong presence worldwide in the upper-end midmarket and large-enterprise environments. Gartner defines the upper-end midmarket as being 500 to 999 employees and the large enterprise as being 1,000 employees or greater.”

This may be the reason why there is such little change over the past year. Typically, enterprise organizations adapt slowly to new technologies, especially when their current solutions are doing for them what they are supposed to. However, given the current environment and the ways in which companies are being forced to view data, there are changes on the horizon. As industries adapt and become more data-driven, those in the enterprise that have largely been unaffected by these factors will begin to feel the pinch, maybe as soon as 2016.