What’s Changed: 2019 Gartner Magic Quadrant for Data Management Solutions for Analytics

Analyst house Gartner, Inc. recently released the 2019 version of its Magic Quadrant for Data Management Solutions for Analytics. The data management products covered here by Gartner encompass software tools that support and manage data in one or more file systems (which are most commonly databases). These databases are often optimized to support analytical processing and the use of machine learning or programming languages like Python or R.

The researcher notes that DMSA is not a technology category, rather it is a use case. These systems are best applied for one of the primary data management use cases, which include: traditional data warehouse, real-time data warehouse, context-independent data warehouse, and logical data warehouse. Gartner adds: “A DMSA may consist of many different technologies in combination. However, any offering or combination of offerings must, at its core, exhibit the capability of providing access to the data under management by open-access tools.”

The larger vendors in this space are increasingly revamping their technologies to match up with enterprise demand while at the same time realizing that relational data warehousing is a cornerstone of DMSA software. This is forcing the smaller, niche providers to zone in on what has made them interesting to a smaller segment of the industry. Capabilities unique to these smaller providers are what makes them noteworthy, as even if they don’t serve the market at large, those they do match up with are seemingly perfect fits.

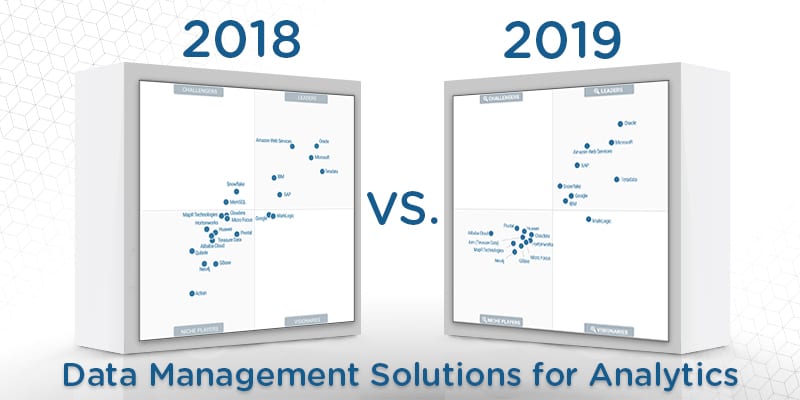

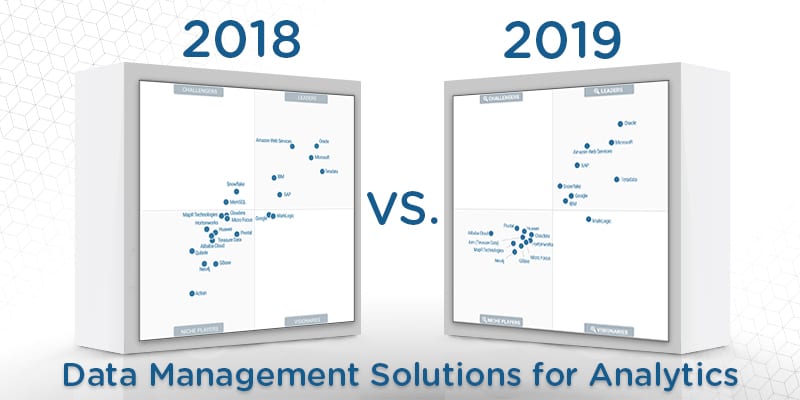

In this Magic Quadrant, Gartner evaluates the strengths and weaknesses of 19 providers that it considers most significant in the marketplace, and provides readers with a graph (the Magic Quadrant) plotting the vendors based on their ability to execute and their completeness of vision. The graph is divided into four quadrants: niche players, challengers, visionaries, and leaders. At Solutions Review, we read the report, available here, and pulled out the key takeaways.

Gartner adjusts its evaluation and inclusion criteria for Magic Quadrants as software markets evolve. As a result, Arm (Treasure Data) has been added to the 2019 report. Actian, MemSQL and Qubole were removed for no longer meeting the researcher’s inclusion thresholds.

Oracle is once again the top DMSA dog, expanding its lead on Gartner’s vertical axis over Microsoft and Amazon Web Services. Oracle recently released a new Autonomous Data Warehouse, and has been increasingly investing in cloud data management over the last year. SAP also saw a bump in its position among the market leaders, largely as a result of renewing its focus on general-purpose data management software.

Teradata retained its position in the lower-right of the leaders bracket and offers data management for analytics across a variety of deployment environments. The company continues to offer a popular best-of-breed solution, and Gartner reference users consider Teradata’s DMSA capabilities to be in the top-third of all vendors included in the report. IBM saw its vertical position regress notably this year, and now runs the risk of falling out of the leaders column altogether if something doesn’t change fast.

Snowflake and Google both made major moves to find themselves included in the leaders bracket in this report. Snowflake was a market challenger last year, and customer reference scores for software experience rank it near the top of the vendors in the space. Google has begun to more prominently focus on selling its data management tools to enterprise companies, and Gartner believes this will continue into the future. It doesn’t hurt that Google is one of the big three cloud providers, either.

MarkLogic is all alone in the market visionaries column after sharing it with Google last year. Gartner notes the company’s new cloud offerings and interesting pricing model as a net positive. MarkLogic’s data hub featuring automatic data integration and a focus on harmonization expands the vendor’s product portfolio and help to make it a foundation in the enterprise.

No market challengers means that the rest of the vendors are tightly positioned in the niche players quadrant. Headlined by Cloudera and Hortonworks, the column features providers with easy name recognition and some without. Featuring the best vertical position for ability to execute, Pivotal offers a popular in-database analytics library that allows for predictive modeling and machine learning to be applied to relational data. The tool’s user base enjoys the performance and scalability of the Pivotal Greenplum platform.

There were no other notable moves in the column, as the niche players either maintained their standing from a year ago or saw it regress slightly. This Magic Quadrant features perhaps the greatest share of positional inequality we’ve seen to date, and with the exception of MarkLogic, the vendors have either obtained widespread adoption or remain focused on niche use cases.