Insurance Companies Need to Insure Enterprise Mobility with MDM

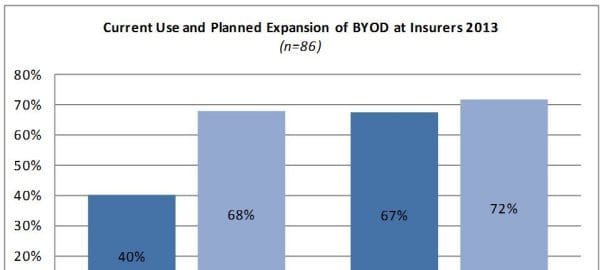

According to the report two-thirds of the 86 mid-size and large P&C and life/annuity insurers surveyed plan to expand their use of BYOD for smartphones and tablets in 2013. Utilizing BYOD programs and increasing the use of corporate applications beyond just email and calendar functions seems to be a trend the report has uncovered as well. With these large and mid sized providers increasing their use of and the capabilities the devices will now have, Novarica strongly suggests that consideration of a Mobile Device Management (MDM) solution. The ability to remote lock/wipe, monitor, secure and grant access will be critical as the devices become more incorporated and intertwined with corporate practices and information.

“We strongly recommend that all insurers carefully consider their security provisions for BYOD and consider the benefits of using an MDM platform if they are not already doing so,” Novarica says in the survey. “Companies need to have remote-wipe capabilities to delete information from lost devices or from the devices of employees who leave the company. Security protocols (passwords, time-outs, not storing unencrypted information on the device, etc.) on personal devices must meet general corporate standards.”