The Strategic Imperative for CFOs to be AI Entrepreneurs

BARC’s Kelly Lynn Kassa offers commentary on the strategic imperative for CFOs to be AI entrepreneurs. This article originally appeared in Insight Jam, an enterprise IT community that enables human conversation on AI.

Finance leaders are uniquely positioned to turn data into enterprise intelligence. As agentic artificial intelligence (AI) and predictive planning reshape performance management, CFOs are in the best position to strengthen their organization’s data foundation by driving value-increasing strategies.

Corporate Performance Management of the Future

Agentic AI has the potential to revolutionize how companies plan, forecast, and measure corporate performance. In BARC’s report, “Predictive Planning and Forecasting on the Rise – Hype or Reality?,” my colleagues Christian Fuchs and Robert Tischler explain:

“The use of predictive algorithms in corporate planning, known as predictive planning and forecasting, has been an important development in finance and controlling over recent years. Its aims are to improve planning and forecasting, and to increase automation in order to reduce the workload of planners.”

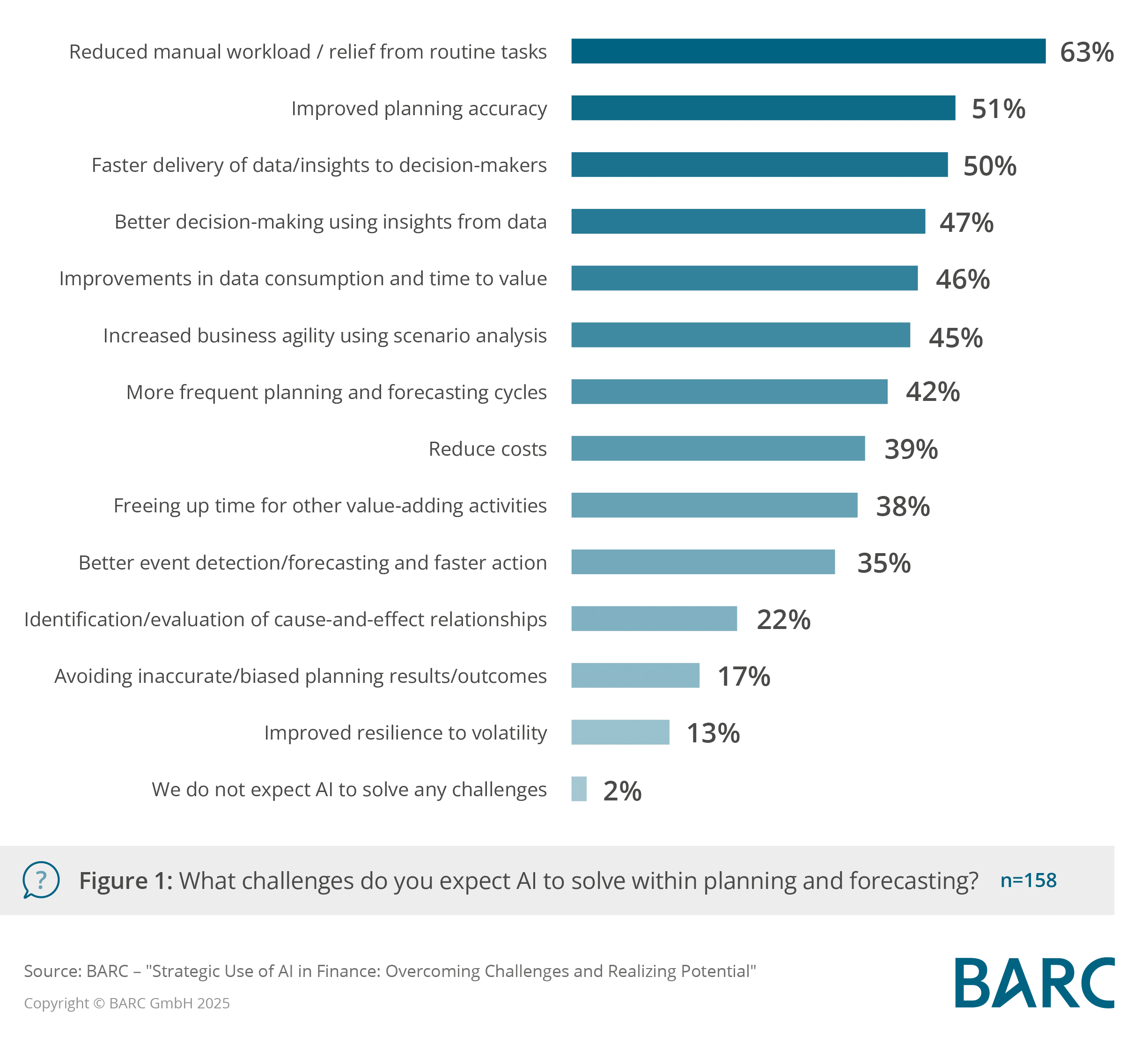

And the same is true for agentic AI. In corporate performance management, agentic AI promises faster delivery of data and insights and deeper analysis to support better decision-making.

Figure 1: What challenges do you expect AI to solve within planning and forecasting? (n=158) Source: Strategic Use of AI in Finance: Overcoming Challenges and Realizing Potential.

Agentic AI presents an opportunity to further evolve all core financial planning and analysis (FP&A) functions. However, that can only happen in companies that have a solid data foundation on which their corporate performance management systems and processes can rely. The key to finance’s success with agentic AI is not just about the use of technology; it’s also about the relevance, quality, and governance of data, along with accountability. CFOs sit at the intersection of finance, data, and intelligence, making them essential to introducing agentic AI into performance management.

Why AI in Finance Depends on Trusted Data

In finance, AI only delivers when underlying data is consistent, clean, and contextualized.

The importance of data quality is not new; it has been a major topic for all organizations for decades. “Governing data is a critical and far-reaching practice area for AI competency,” write Kevin Petrie, vice president of research at BARC U.S., and Shawn Rogers, CEO at BARC U.S., in “Preparing and Delivering Data for AI.”

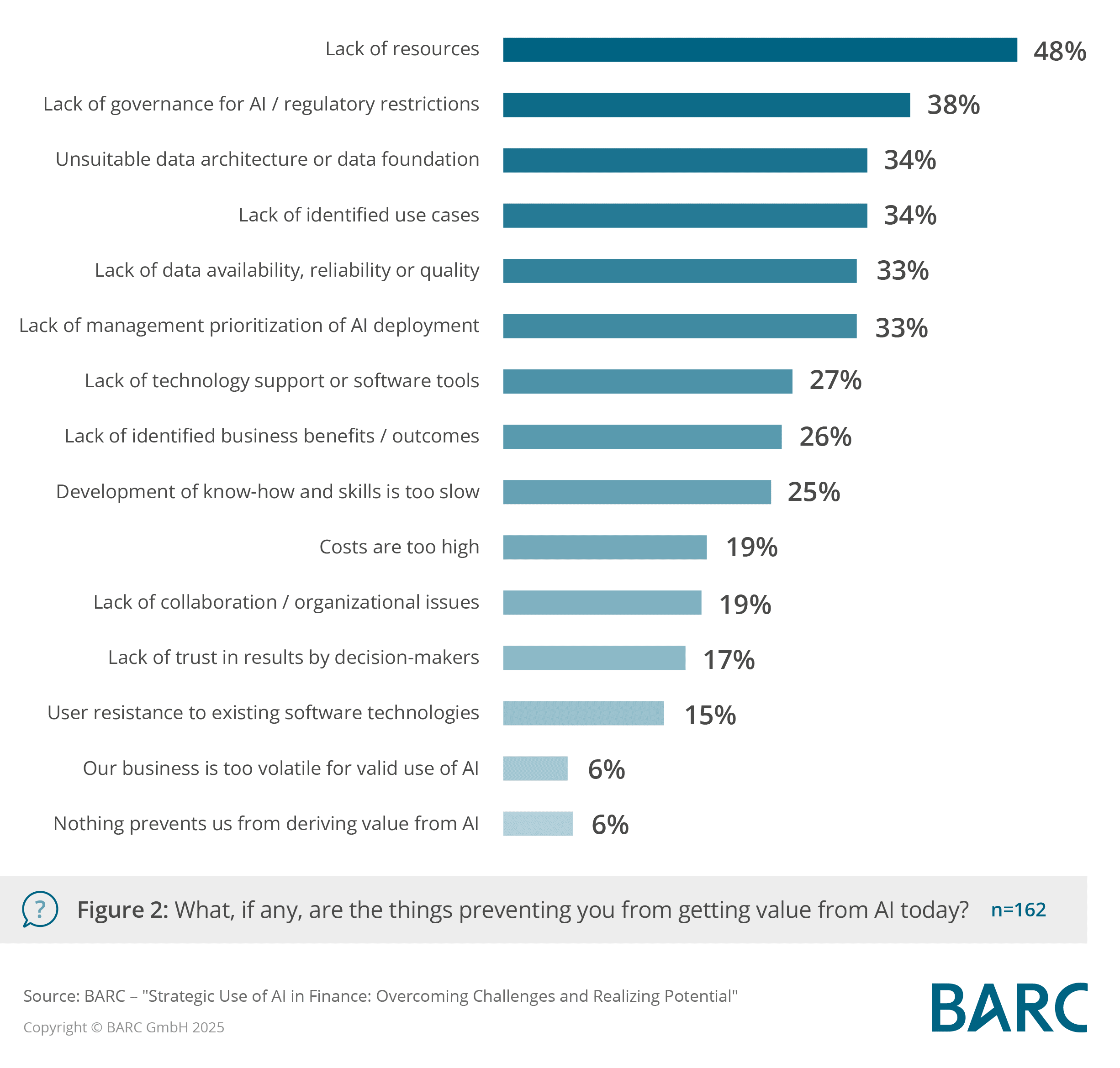

With agentic AI, the stakes are even higher—especially for finance. That presents a massive challenge for many organizations. BARC research shows that 34% survey respondents cited “unsuitable data architecture or data foundation” as an issue preventing the organization from getting value from AI today. Our research also found that 33% of organizations struggle with data integration and quality. These functions are vital to having a strong data foundation.

Figure 2: What, if any, are the things preventing you from getting value from AI today? (n=162) Source: Strategic Use of AI in Finance: Overcoming Challenges and Realizing Potential.

The Evolution of the CFO

Traditionally, CFOs and FP&A team members have been forced to grind through far too many Excel spreadsheets, or as most call it, “spreadsheet hell.” That is no longer true for leading companies; 68% of companies surveyed in The Planning Survey 25 rely on specialized planning products for the dominant aspects of their planning activities.

Many companies using modern planning tools are experiencing the evolution of the CFO role. The CFO is embracing proactive, insight-driven leadership that facilitates strategic decision-making for the entire organization, not just the department of finance. They are still guardians of financial accuracy, but they need to do far more in this age of agentic AI. They need to become architects of enterprise insight and advocates of intelligent automation. They must design how data flows, integrates, and informs strategy.

Our research shows that predictive planning is already used productively by 27 percent of organizations, and 65 percent are either achieving or expecting significant benefits. Improved accuracy and reduced effort in standard FP&A activities are also reported by 64 percent of respondents.

Clearly, predictive planning and AI forecasting are no longer niche—they are finance’s next frontier. They also enable a meaningful jump in the perception and reality of the role of the CFO. But without trusted and quality data, expect a rough landing.

The CFO’s office is the only function combining data, governance, and strategic insight for the whole organization. Finance teams have the knowledge and ability to operationalize AI for corporate performance management by:

- Integrating data sources across finance, operations, and HR

- Establishing governance frameworks for data lineage and model transparency

- Fostering data culture and literacy within finance and beyond

- Partnering with the CIO/CDO on enterprise-wide standards

Tomorrow’s CFO

In the past, the CFO was only viewed as being in charge of the numbers. Budgeting, planning, and reporting were onerous tasks that impeded deep, thoughtful analysis and strategic recommendations. Tomorrow’s CFOs are not just responsible for financial results. They must build and maintain the required foundations to fully exploit the opportunities presented by AI. They are responsible for ensuring that every decision is grounded in trusted data, because AI’s success depends entirely on that data. That is the future of data-based insight for corporate performance management.