2015 Gartner EMM Magic Quadrant: Whats Changed Since 2014?

Like it has for many years, the Garner Magic Quadrant reports have laid the foundation for buyers everywhere looking for the best technology in each space. Gartner evaluates each solution included in the quadrant and breaks them down into strengths and cautions and categorizes them based on their completeness of vison and ability to execute into four groups: Leaders, Visionaries, Challengers and Niche Players.

It has been just over a year since their last EMM Magic Quadrant release and the Enterprise Mobility market has evolved and grown quite a bit. So how does this year’s report reflect that evolution? Let’s take a look. Last year, and rightfully so, Gartner shifted away from Mobile Device Management (MDM) and began focusing on EMM which reflected the growth and sophistication of mobility within the enterprise. They stated the MDM was now one of three pillars need to truly secure and manage mobility within the enterprise. The other two pillars being Mobile Application Management (MAM) and Mobile Content Management (MCM).

In their 2015 report they have added a forth core pillar that help IT manage and secure enterprise mobility – Mobile Identity. Gartner writes this about mobile identity, “EMM tools help ensure only trusted devices and users access enterprise applications. Mobile identity capabilities may utilize one or more use of the following technologies: user and device certificates, app code signing, authentication, and single sign-on. EMM tools are increasingly using contextual information (such as location and time) to help inform access decisions.” Again, this expansion in EMM core capabilities reflects the evolution, sophistication and importance of enterprise mobility in today’s organizations.

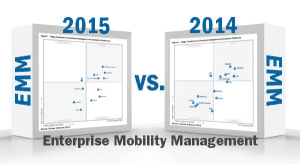

In looking at the Quadrant itself and where EMM providers are plotted there has not been a world of change. Those who are still included remain in the same quadrants as last year with slight movements for a few:

Leaders – AirWatch by VMware, MobileIron, IBM, Good Technology and Citrix

Visionaries – Soti, Sophos and Microsoft (included this year)

Challengers – SAP

Niche – BlackBerry, Landesk and Globo

Out – Tangoe, Absolute Software and Symantec

Of all those included in the 2015 EMM Magic Quadrant BlackBerry and Soti seem to have the most movement within their respective categories. Within the Niche category BlackBerry move up and to the right and in now positioned in the top right-hand corner. This positive movement can be attributed to the release of BlackBerry Enterprise Service 12 (BES12) towards the end of 2014. Gartner writes, “BES12 provides improved non-BlackBerry OS support, and it consolidates the management of BlackBerry devices, which previously required separate versions of BlackBerry Enterprise Service, depending on the type of device. BES12 is a more complete EMM product than prior versions, and it should meet many organizations’ requirements for cross-platform management.”

In Soti’s case they move down away from leaders category and deeper into the visionaries category. This movement deeper into the visionaries category can be attributed to their heavy focus on Android devices. Version 12.1 and their MobiControl Android+ technology will offer a high level of control in Android environments but Gartner states they may not be the best fit for organization moving heavily towards BYOD programs where iOS, BlackBerry and Windows devices are prevalent. “Soti is used less frequently as an EMM product where BYOD is the predominant scenario, and we sometimes find Soti customers using another EMM products for iOS, Windows Phone and Mac OS X devices.”

And quickly for those who were not included in Gartner’s 2015 Magic Quadrant for EMM.

Symantec – Did not have the revenue necessary for inclusion.

Tangoe – With a heavy focus on Telecom Expense Management (TEM) and Managed Mobility Services (MMS) they are taking a partnership approach with EMM vendors rather than developing their own holistic solution.

Absolute Software – Have invested heavily enough in the MAM and MCM pillars of EMM however they do offer a very solid MDM solution for those “ looking to extend MDM from their client management tool consoles.”

Gartner also offers a market overview of predictions and focuses for the 2015 EMM market which touches on the different kinds of data mobile strategy will have to deal with his year. Not only are enterprises needing to keep track of email, contacts and calendars, but other data as well, which can include wearables and other technology that will pop up within the next year. This makes the Visionaries category especially important because they are on the right track for the future of EMM.

Click here to access the complete 2015 Gartner Magic Quadrant for EMM compliments of IBM.

A Couple of Other Reports to Consider

2015 Solutions Review Enterprise Mobility Management Buyers Guide