Gartner’s Magic Quadrant for Data Center Backup and Recovery Solutions: What’s Changed

Gartner just released the latest version of its Magic Quadrant report for Data Center Backup and Recovery Solutions. The report aims to offer an in-depth analysis of the leading data center and backup solution providers that offer traditional as well as innovative availability capabilities.

Gartner just released the latest version of its Magic Quadrant report for Data Center Backup and Recovery Solutions. The report aims to offer an in-depth analysis of the leading data center and backup solution providers that offer traditional as well as innovative availability capabilities.

Gartner defines data center backup and recovery platforms as “solutions focused on providing backup capabilities for the upper-end midmarket and large enterprise environments.” The tech giant says the upper-end midmarket is classified as having 500 to 999 employees, and large enterprises reportedly have over 1,000 employees.

“Protected data comprises data center workloads, such as file share, file system, operating system, hypervisor, database, email, content management, CRM, ERP and collaboration application data,” according to Gartner. “Today, these workloads are largely on-premises; however, protecting SaaS applications (such as Salesforce and Microsoft Office 365 [O365]) and infrastructure as a service (IaaS) are becoming increasingly important, as are other, newer ‘born in the public, private or hybrid cloud’ applications.”

In terms of predictions, the report states that 50 percent of organizations will replace their current backup application by 2021, even if they deployed a new tool at the start of 2017. And by 2022, about 20 percent of storage systems are predicted to be self-protecting.

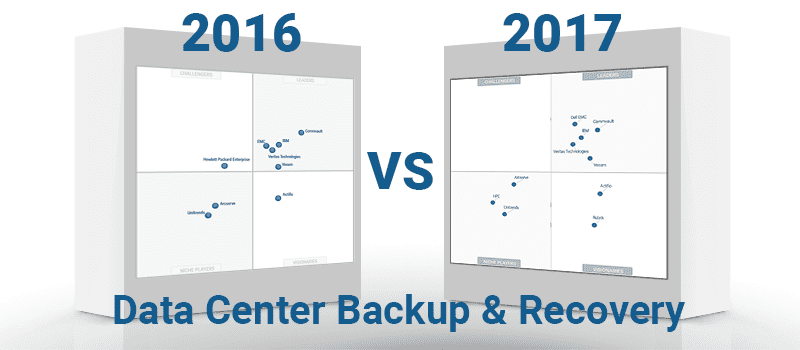

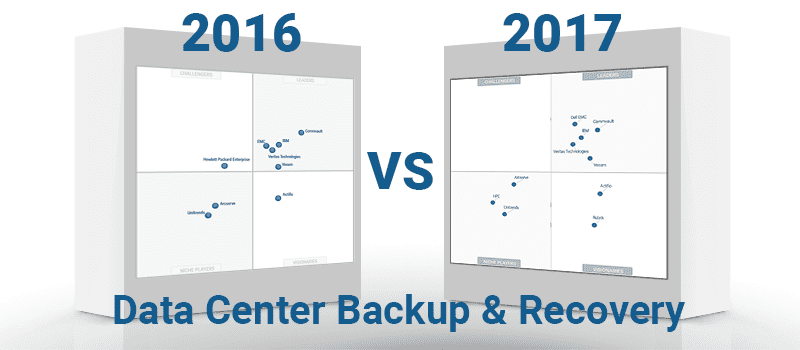

Now let’s take a look at the vendors and see what’s changed since last year’s report. Gartner uses its own inclusion criteria, including the ability to execute and completeness of vision, to plot the vendors on the quadrant.

Challengers

When the Magic Quadrant was released last year, Hewlett Packard Enterprise (HPE) was the only challenger listed. This year, there aren’t any challengers in the report.

Niche Players

As of 2016, Arcserve and Unitrends were named niche players. This year, both vendors remained in the niche players category but were joined by HPE, who moved up from the challenger’s bucket.

“In the last year, HPE completed a much-overdue Data Protector graphical user interface (GUI) overhaul, improved back-end product communication, and added backup analytics enhancements to the Backup Navigator product for problem remediation and service-level assurance,” Gartner stated.

Visionaries

Gartner defines visionaries as “forward-thinking, advancing their portfolio capabilities ahead, or well ahead, of the market, but their overall execution has not propelled them into being Challengers or possibly Leaders (often due to limited sales and marketing or elongated time to initially install and configure, but sometimes due to scalability or breadth of functionality and/or platform support).”

Last year, Actifio stood alone in the visionaries quadrant. The vendor remains in the same quadrant this year, but has company. In the 2017 report, Rubrik joins Actifio in the visionaries bucket. Rubrik wasn’t included in the report at all last year. One of the provider’s strengths is that it offers, “Modern backup and recovery techniques, coupled with deployment, management and pricing simplicity, drive market adoption,” according to the report.

Leaders

The leaders section of the quadrant was the most crowded in 2016 and that didn’t change this year. Neither did the vendors. The same vendors that were in the leaders quadrant last year remained, including Dell EMC, Commvault, IBM, Veritas Technologies, and Veeam.

Click here for the entire report.