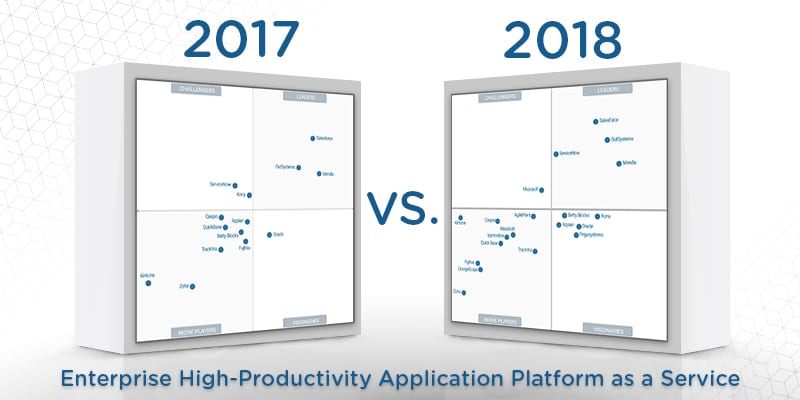

2018 Gartner Magic Quadrant for Enterprise High-Productivity Application Platform as a Service: What’s Changed?

Analyst house Gartner, Inc. recently released their annual Gartner Magic Quadrant for Enterprise High-Productivity Application Platform as a Service. Gartner recognizes the importance of high-productivity application as a service (hpaPaaS) for enterprises and small to medium-sized businesses. These hpaPaaS clouds are simpler to use than an aPaaS provider, as they require less knowledge of programming.

In this report, Gartner evaluates the strengths and weakness of 20 hpaPaaS providers. The Magic Quadrant graphic plots the vendors based on completeness of their vision and ability to execute. From here, the vendors can end up in four different categories: Niche Players, Visionaries, Challengers, and Leaders.

Widget not in any sidebars

The 20 hpaPaaS providers selected for this year’s report are: AgilePoint, Appian, Betty Blocks, bpm’online, Caspio, Fujitsu, Kintone, Kony, MatsSoft, Mendix, Microsoft, Oracle, OrangeScape, OutSystems, Pegasystems, Quick Base, Salesforce, ServiceNow, Trackvia, and Zoho.

How Gartner defines hpaPaaS

There are a lot of different PaaS offerings and buzzwords surrounding it. It doesn’t feel much different here, so what really separates hpaPaaS from PaaS or aPaaS? The key difference is hpaPaaS provides rapid application development features for development, deployment, and execution. They offer low-code or no-code deployment, while a traditional aPaaS offer high-control. High-control tends to require more professional programming experience.

HpaPaaS is about, what Gartner calls, “citizen engineers.” Many vendors include simple drag and drop interfaces in developing programs for enterprises to use. The vendors listed have enterprise-level support, but many can work with smaller companies looking for a simple cloud to use.

Some new faces

This year’s Magic Quadrant adds six new names to the market, AgilePoint, bpm’online, MatsSoft, Microsoft, Orangescape, and Pegasystems. Only two of these vendors, Pegasystems and Microsoft, were listed outside of the Niche players category. This year there is one vendor listed in the Challenger category, which is unusual. This quadrant only consists of four leaders, one more than last year.

Widget not in any sidebars

Category breakdown

The Leaders section contains vendors that combine detailed understandings of the market, reliability, and the ability to lead the market forward. They need to stand ahead of the crowd in both execution and vision. With the increased number of vendors in this space, Gartner believes that there will be more vendors entering the Leader category within the next few years. The four vendors that made the cut were Mendix, Outsystems, Salesforce, and ServiceNow.

The Challenger section consists of vendors that excel in being able to attract a large user following but are limited to a subset of the market. Specialization may be what keeps them out of being a Leader. Gartner says they must adopt aggressive and innovative strategies to expand their market reach. The only vendor listed here is Microsoft, who is new to the market with hpaPaaS tools focused on Office 365.

Gartner sees Visionaries as vendors who are innovators driving the market. These vendors tend to appeal to “leading-edge” customers and may not have mainstream notoriety. They don’t have the market dependability some of the vendors in the Challenger or Leaders section have. In the quadrant itself, visionaries have a standout “completeness of vision” but might not have the same “ability to execute,” for any reason. The five vendors in this section were Appian, Betty Block, Kony, Oracle, and Pegasystems.

Niche Players is the final category. Gartner defines niche players as vendors who specialize in certain market segments. Specifically, they are focusing on the SMB market. Some of these vendors are working towards improving their standings on the quadrant, while others may be fine in focusing on their specific expertise. The vendors listed here are: AgilePoint, bpm’online, Caspio, Fujitsu, Kintone, MatsSoft, OrangeScape, Quick Base, TrackVia, and Zoho.

What to expect going forward

Gartner points out that this market remains open to new players. They counted 75 hpaPaaS vendors when they started the research, and this grew to 85 by the time of the MQ release. Microsoft’s decision to enter this market is telling. The market is open, and other big and small players are bound to stand out soon.

Also, be sure to check out our coverage of the Magic Quadrant for cloud MSPs to better understand this changing cloud market.

Widget not in any sidebars