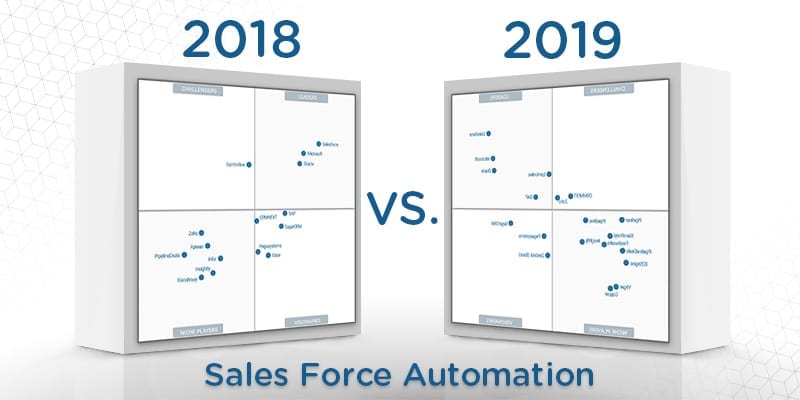

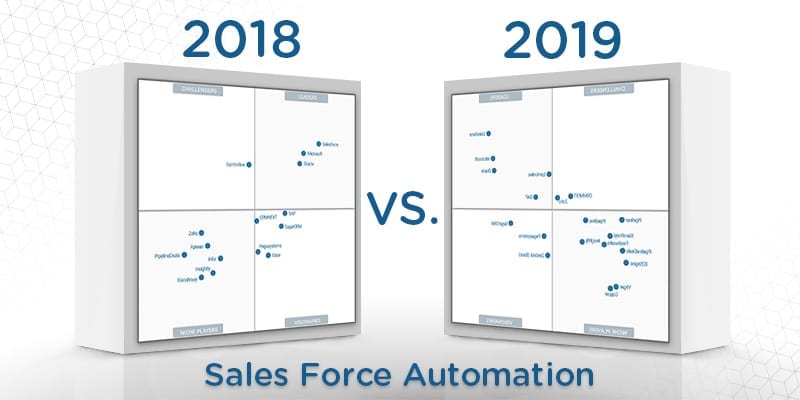

What’s Changed: 2019 Gartner Magic Quadrant for Sales Force Automation

The editors at Solutions Review highlight what’s changed since the last iteration of the Gartner Magic Quadrant for Sales Force Automation and provide an analysis of the new report.

Analyst house Gartner, Inc. recently released the 2019 version of its Magic Quadrant for Sales Force Automation. Sales Force Automation is defined as systems that support the automation of sales activities, processes, and administrative responsibilities. This includes account, contact, opportunity management, sales activity management, sales forecasting, mobile applications, reporting, PRM, and other platform capabilities. This year’s report revealed that the market has grown 12.8% and that vendors improve their AI for data capture, predictive analytics, and relationship intelligence.

Additionally, three major trends have revealed themselves in the SFA market; the first being digital optimization objectives now drive many sales technology purchase decisions. This is often dubbed “digital transformation” and is mostly driven by building a data-driven sales organization. Gartner’s client interest in digital optimization has grown nearly 100% since last year’s report.

Another trend is application leaders think of SFA as at least a five-year commitment. Based on this year’s Gartner data, 42% of SFA implementations are over three years old. Large enterprise-size sales teams, in particular, seek assurances of “future proof” technology that can continue to exhibit strong SFA capabilities over a period of time. The third SFA trend of this year is that integration with party applications is an essential requirement. No SFA vendor provides every sales technology that a business will need, so Gartner clients frequently ask about third-party application integration possibilities, as well as first-party ERP and marketing automation integrations.

What’s Changed: 2019 Gartner Magic Quadrant for Sales Force Automation

In this Magic Quadrant, Gartner evaluates the strengths and weaknesses of 19 providers that it considers most significant in the marketplace and provides readers with a graph (the Magic Quadrant) plotting the vendors based on their ability to execute and their completeness of vision. The graph is divided into four quadrants: niche players, challengers, visionaries, and leaders. At Solutions Review, we’ve read the report, available here, and pulled out the key takeaways.

Gartner adjusts its evaluation and inclusion criteria for Magic Quadrants as markets evolve. As a result, Copper, Freshworks, Pipedrive, Pipeliner, Vtiger, and X2Engine have been added to this year’s report. Aptean and Infor have been removed.

Leaders

Salesforce tops the Leaders category with its notably strong market strategy and a wide variety of industry-specific software solutions. Over the past year, it has continued to deliver many product enhancements, and customers have praised the platform for its ability to support agile development and custom applications. Microsoft maintains its position by attracting new ISVs and application offerings, which extends the capabilities of its software without requiring the creation of custom extensions. Microsoft has also been praised for its scalability, as well as the wide scope of its products.

Oracle offers a wide span of industry-specific software and provides solutions relevant to all B2B and B2C long- and short-cycle use cases and indirect sales. Customers have also cited positive product deployment and good technical support from Oracle customer service. bpm’online has moved from Challenger to Leader, receiving the highest overall customer experience scores in this report for the third consecutive year. It also received the highest ease-of-use score. SAP has managed to break into the Leaders category and one of the largest implementation partner networks and a variety of prepackaged industry products.

Challengers

This year’s Challengers category features two newcomers. Zoho’s movement was driven by its improved sales execution, market strategy, and customer service, as well as the scope of its product capabilities. Additionally, Zoho is the only vendor in this Magic Quadrant that will refund money to clients if the implementation doesn’t work out or the product isn’t to their liking. In the past year, Zoho has enhanced its CRM with new GDPR compliance functions, email authentication, and virtual meetings. These features are useful for software buyers that require worldwide lead management processes.

CRMNEXT has made the jump from the Niche Players category into the Challengers category. It offers several deployment options: it supports SaaS through cloud provided by AWS, private cloud managed by customers or a third party, and on-premises. This vendor has also been praised for its UI, easy navigation, and customization possibilities. Organizations that require individual workflows and particular sales processes will benefit from CRMNEXT.

Visionaries

SugarCRM maintained its position as a Visionary with its well-executed marketing strategy and revamped selling model focused on enterprise IT organizations. SugarCRM received some of the highest scores for customer service and product support processes, primarily due to the depth of support offering: self-service, VIP support, customer and partner support, as well as code customization reviews.

Pegasystems provides comprehensive vertical-packaged products for various industries and is primarily deployed by large enterprises with complex B2C or indirect sales processes. This platform has been praised for its low-code capabilities, allowing business professionals and leaders to create custom applications and workflows without programming experience. Zendesk has strongly improved its sales and marketing execution over the past year. Unlike other vendors, implementation services and costs are included in the cost of the Zendesk license, making it a good choice for organizations that need to implement an SFA solution quickly.

Niche Players

This year’s Niche Players quadrant is filled with new vendors, while some of last year’s vendors have seen vertical growth. Pipeliner is new to this year’s report and is already on the verge of crossing into the Challengers category. Pipeliner offers strong mobile capabilities, including AI functions for activity management and offline read/write access. This vendor has also received positive scores for its quality of technical support.

Pipedrive is another newcomer that’s starting close to the Challengers quadrant. Pipedrive’s integration possibilities with calendaring solutions such as Outlook and Google provide sales reps with greater scheduling and organization capabilities. Users have given this vendor positive scores for its account management, activity management, opportunity, and lead management functions.

Xiaoshouyi has gained vertical momentum, passing its competitors from last year’s report. Its advanced analytics capabilities will help administrators define and manage opportunity scoring schemes, and developers can build custom mobile apps using their APIs. Insightly has also moved closer to the Challengers quadrant, with customers stating that it was easy to implement and required comparatively little end-user training. Insightly also features improved usability functions, such as automated associated to LinkedIn profile records and email template integration.

Freshworks starts strong in its first year of this Magic Quadrant. This year features Office 365 calendar integration, configurable sales activities, integration to HubSpot for marketing automation, and enhanced lead scoring capabilities. It is one of the fastest-growing vendors in this Magic Quadrant and has doubled its customer base in the past year. PipelineDeals has received positive customer reviews for its contracting flexibility; customers have noted that they can cancel their contracts at any time and have greater freedom with fixed pricing for extended periods of time.

X2Engine makes its first appearance in this Magic Quadrant and has been reviewed positively for its customer support and ease of deployment and integration. Vtiger starts strong with its CRM configuration options and native sales capabilities. At the same time, Copper offers unique functions such as automated “who knows who” functions, automated activity capture from emails, and much more.