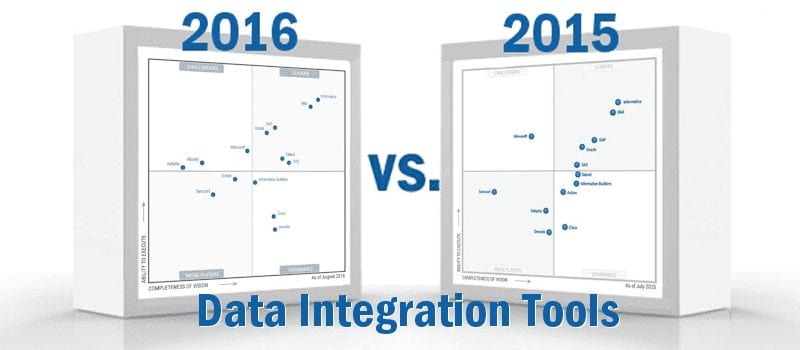

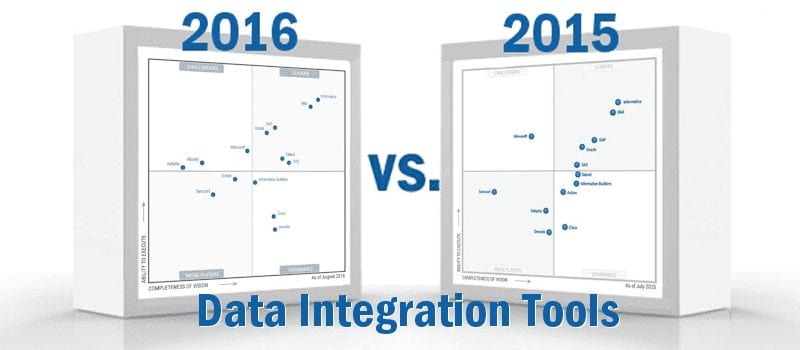

What’s Changed: 2016 Gartner Magic Quadrant for Data Integration Tools

Gartner recently released the 2016 version of their Magic Quadrant for Data Integration Tools. According to Gartner, the market for enterprise integration tools was worth $2.8 billion at the end of 2015, representing a 10.5 percent increase from the year prior. The technology research giant defines Data Integration capabilities as: “Comprising the practices, architectural techniques and tools that ingest, transform, combine and provision data across the spectrum of information types in the enterprise and beyond — to meet the data consumption requirements of all applications and business processes.”

According to Gartner, organizations are increasingly looking for solutions that provide them with Data Virtualization capabilities and the ability to combine Data Lakes with their existing platforms since the overbearing expectation is that Data Integration will become cloud and on-premise agnostic. As a result, vendors are increasingly offering tools that enable widespread data access and data delivery infrastructure for a wide variety of integration scenarios, including data acquisition for Business Intelligence, Data Analytics, and data warehousing, data migration, data sharing, and support for Master Data Management and Data Governance.

Demand for legacy tools has waned as modern capabilities evolve, with new tools offering ways for organizations to split the demands of Data Integration so that they may integrate both data and processes with partners and growing digital customer bases. While legacy bulk/batch integration still makes up the vast majority of the software market (Gartner estimates 80 percent), forward-thinking companies have begun to shift their focus to Data Virtualization and synchronization. In this way, mobile devices, consumer applications, multi-channel interactions and social media are driving enterprises to build sophisticated integration architectures.

Informatica and IBM remain the class of this market, furthering their standing as the unquestioned leaders in enterprise Data Integration. Informatica doesn’t have much room left to expand, and if they continue to dominate the market they way they have in recent years, Gartner may have to handicap them. Informatica continues to build upon their impressive offerings portfolio, and recently unveiled several new hourly-priced AWS Data Management tools. IBM remains Informatica’s one true challenger for dominance in the integration sector.

SAP and Oracle remain tightly grouped in the middle of the leaders bracket, though both mega-vendors lost standing in Gartner’s completeness of vision metric. SAP has supplanted itself as a leader in this software sector, and with no end in sight, the company continues to attract customers that seek a mix of granularity, latency and physical and virtualized data delivery. Oracle’s strong 2015 came as a result of releasing GoldenGate for Big Data, which includes push-down to Spark and the introduction of self-service integration capabilities for data preparation. Talend and SAS round out the leaders column in this year’s study.

Microsoft now finds itself well within striking distance of joining Talend as a market leader after improving in Gartner’s completeness of vision metric this year. Attunity, the only new vendor in this year’s report, and Chicago-based Adeptia, join Microsoft as market challengers. Attunity has strong traction in this space and has been delivering data replication and synchronization capabilities for more than two decades. Adeptia’s integration tool offers attractive pricing and flexibility, as well as iPaaS capabilities, enabling inenterprise data sharing use cases.

Visionaries in this market segment for 2016 are Information Builders, Cisco, and Denodo. Information Builders does it all, offering integration software, Big Data support, and Business Intelligence and Data Analytics. Denodo’s placement as a challenger is an upgrade over last year’s stay in the niche player’s bracket. Actian regressed in this year’s report, though did improve their ability to executive metric, and although Gartner views the vendor as a niche player for 2016, Actian is within striking distance of upgrading their standing considerably with a positive year ahead. Syncsort remains a niche player, and their standing in the column was downgraded noticeably. Better days are surely ahead, as Syncsort offers high performance ETL processing, a low cost of ownership compared to market leaders, and swift time-to-value.

Read Gartner’s Magic Quadrant.

Widget not in any sidebars

[youtube https://www.youtube.com/watch?v=beLcYabuj6c&w=560&h=315]