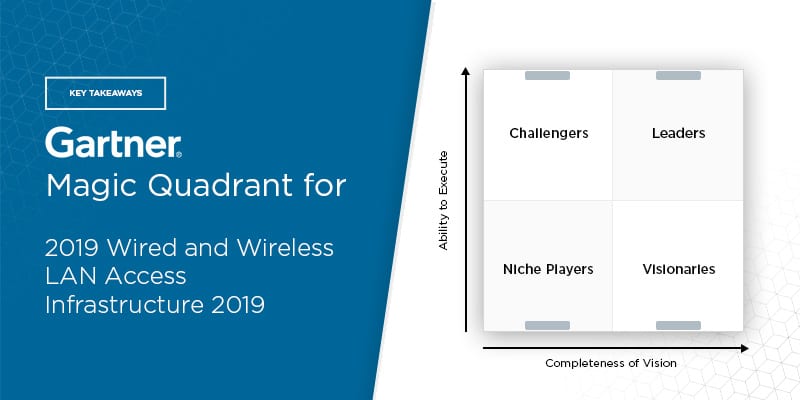

Gartner’s 2019 Magic Quadrant for Wired and Wireless LAN Access Infrastructure: Key Takeaways

Tech analyst house Gartner, Inc. recently released their 2019 Wired and Wireless LAN Access Infrastructure Magic Quadrant. Gartner describes wired and wireless LAN access infrastructure as “wired and wireless networking hardware and software that enable devices to connect to the enterprise wired LAN or Wi-Fi network.” These devices, according to Gartner, include laptops, smartphones, tablets, networked office equipment, and Internet of Things (IoT) endpoints.

Wireless LAN (WLAN) networks are often the first (or only) point of connection for employee devices, especially their smartphones and laptops, as well as smart office equipment. As a result, enterprises are focusing on WLAN service quality and moving beyond solutions that provide simply connectivity, management, and security features. These features are increasingly important as more companies adopt IoT devices into their infrastructure — devices that require new methods of access and security management to operate safely.

This Magic Quadrant analyzes 18 wired/wireless LAN access infrastructure vendors, listing their capabilities, strengths, and weaknesses. Gartner then arranges these vendors into their Magic Quadrant based on the completeness of their vision and their ability to execute. The Magic Quadrant contains four sections: Leaders, Challengers, Visionaries, and Niche Players. Thanks to a series of mergers and acquisitions, Gartner has noted a consolidation in the vendor market for LAN access infrastructure solutions. This, Gartner speculates, indicates that users want more unified wired/wireless LAN infrastructure tools that don’t require third-party services or partners for WLAN technology development.

At Solutions Review, we read the Magic Quadrant report, available here, and pulled out the key takeaways in the wired and wireless LAN access infrastructure space, including vendor positions and where the LAN access infrastructure market is headed.

Three vendors inhabit the Leaders quadrant this year: Cisco, Aruba (a subsidiary of HPE), and Exterme Networks. Cisco continues its “wireless-first” initiative that began in 2018, which has seen the introduction of multigigabit (mGig) Ethernet switches and pre-standards 802.11ax (or WiFi 6) devices. They’re roughly neck and neck with Aruba, the second-largest LAN access infrastructure vendor worldwide. In 2019, Aruba focused heavily on addressing the management and security needs of companies with IoT devices. Extreme Networks gained significant attention with the completion of their acquisition of Aerohive Networks, which added Aerohive’s SD-WAN and cloud-based management solutions to their portfolio.

There were no Challengers in this Magic Quadrant, but Mist Systems (acquired by Juniper Networks) and Huawei filled out the Visionaries section this year. The acquisition of Mist Systems by Juniper Networks, completed in April 2019, brought Mist’s pre-standards WiFi 6 solutions (including spectrum monitoring and security threat detection) together with Juniper’s mGig EX switching. Huawei continues to maintain their strength in the Asian and Pacific regions while also experiencing significant growth in the Latin American and EMEA market; however, Gartner notes that Huawei continues to lack presence in other markets.

Contrary to the other quadrants, the Niche Players section is packed to the brim with LAN access infrastructure vendors, with 13 providers crowding the square. Fortinet is positioned closest to the center of the Quadrant, and was given the highest ranking for both the completeness of their vision and ability to execute. Gartner highlighted their acquisitions of ZoneFox and Bradford Networks, as well as the introduction of their security-based user and entity behavior analytics solution, FortiInsight.

Ruckus Networks (acquired by CommScope in April 2019) and ALE are almost dead even in the quadrant. CommScope is the third corporation to own Ruckus Networks since 2017, but their global market share and revenue were some of the highest in the WLAN infrastructure field in 2018. ALE has continued to push their homegrown product lines but has focused more on midsize enterprises. Slightly behind these two in terms of vision completeness is Dell EMC, who offers OEM versions of Ruckus and Aerohive WLAN technologies.

H3C and Ruijie Networks have both gained significant ground in the Asian and Pacific regions, specifically in their home country of China — though they haven’t expanded as much outside these territories. LANCOM Systems, which operates out of Germany, has traditionally focused on the European market, but their recent acquisition by Rohde & Schwartz may help them gain traction in other markets. The Japanese company Allied Telesis currently lacks sufficient real-time traffic analysis capabilities, but Gartner commented that their roadmap aligns with customer needs for an integrated solution.

Mojo Networks (a subsidiary of Arista Networks) is about to fully complete their merger with Arista at the end of their fiscal year, allowing them to gain Arista’s WLAN product support. Cambium Networks recently announced that they had acquired Riverbed’s Xirrus WLAN infrastructure solution, which Gartner believes should boost their wireless market share. Gartner proclaimed that D-Link received positive customer feedback and features competitive pricing, but also that they aren’t as equipped to deal with complex deployments. Based on public information, the Gartner researchers declared Ubiquiti Networks as a low-cost option for midsize and large enterprises, though their support outside U.S. and Canada is limited. Finally, Chinese vendor TP-Link is also considered a decent low-cost pick for businesses, though they currently no IoT-specific management service support and limited machine learning and AI capabilities.

Looking for more information on wireless networks, 802.11ax, and wireless hardware vendors? Our Wireless Networks Buyer’s Guide contains profiles on the top wireless network solution providers, as well as specifications on the network hardware they provide. It also includes questions you should ask potential vendors and yourself before buying.

Check us out on Twitter for the latest in Wireless Networks news and developments!